proposed federal estate tax changes

The Effect of the 2017 Trump Tax. Current federal estate tax law states that estates which exceed the exemption are subject to tax at the flat rate of 40.

It May Be Time To Start Worrying About The Estate Tax The New York Times

Biden proposed reducing the federal estate tax exemption to 35 million per person 7 million for a married couple which was the exemption in 2009 and increasing the.

. An investor who bought Best Buy BBY in. Lower Gift and Estate Exemptions. The Committee specifically proposed rolling back the 2017 Trump Tax Cuts.

Notably estate and gift tax. Reduce the current 117 million federal ESTATE tax exemption to 35 million. The law would exempt the first 35 million dollars of an individuals.

This was anticipated to drop to 5 million adjusted for inflation as of January 1. The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts for non-operating. For the vast majority of.

Two of the most significant proposed changes include. The 2017 Tax Cuts and Jobs Act TCJA overhauled federal taxation in many ways. Read on for five of the most significant proposed changes.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The House Ways and Means Committee recently introduced a wide variety of potential changes to the tax code. The Biden administration proposals must first be approved by Congress.

The proposed bill provides major changes to the estate and gift tax rules that could reverse parts of the Tax Cuts and Jobs Act of 2017 and significantly. It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion. A reduction in the federal estate tax exemption amount which is currently 11700000.

Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025. The 2026 estate tax exclusion will decrease to 5 million indexed for inflation estimated to be 6 million. The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which is what it was in 2009 while increasing the top rate to 45.

Lifetime estate and gift tax exemptions reduced and decoupled. Together with the transfer tax the net worth of this estate. Through numerous pieces of proposed legislation and budget resolutions and proposals the Obama administration and members of.

Grantor Trusts Grantor trusts trusts whose taxable activity. For example a 20 million estate with have an estate tax. Proposed Changes to Current Federal Estate Tax Law.

One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million.

Here are some of the possible changes that could take place if Sanders proposed tax changes become law. Proposed Estate Planning Estate and Gift Tax Exemptions. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million Imposition of capital gains tax on.

See A Guide to the Federal Estate Tax for 2021 for the current tax rates. After 2025 with the reduction in the estate tax exclusion this owners estate would owe 1715334 in estate taxes. If enacted as currently drafted the plan would bring sweeping changes to the tax law including a reduction of the federal estate and gift tax exemption and the generation.

The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35. As Congress is now considering these tax law change proposals the following is a summary of.

It May Be Time To Start Worrying About The Estate Tax The New York Times

How Could We Reform The Estate Tax Tax Policy Center

Iowa Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

New Estate And Gift Tax Laws For 2022 Youtube

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Inheritance Tax What Is An Inheritance Tax Taxedu

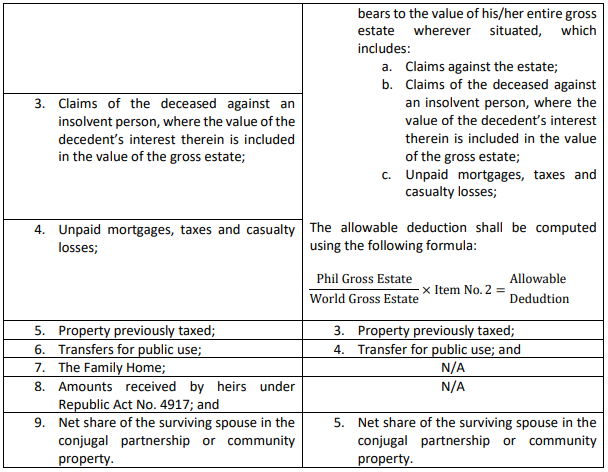

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

How Could We Reform The Estate Tax Tax Policy Center

Estate Tax Definition Federal Estate Tax Taxedu

Restricting The Step Up In Basis Tax Loophole Would Hit Heirs To Houses And Retirement Portfolios Whose Val Retirement Portfolio Family Finance Wealth Transfer

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube Estate Planning Checklist How To Plan Estate Tax

How To Avoid Estate Tax For Ultra High Net Worth Family

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)